SIMULATOR Algorithm

Overview

The simulator algorithm simulates order execution on an exchange using prices from a real exchange using the Deltix QuoteFlow library.

Features:

- The simulator tries to reconstruct a Level3 order book (market by order) from Level1 or Level2 feeds, coming from a simulated exchange.

- The simulator can produce a market data feed that shows the prices of passive simulated orders and trades.

The simulator does not perform matching/crossing of orders submitted to it. It simulates execution using prices from an exchange order book. Use matching engines provided with Ember if you want internal order crossing market.

The algorithm can consume data from an external liquidity provider and generate executions based on this feed. It has two use cases:

- Executing orders based on real-time data.

- Simulating for strategy-backed testing.

Strategy-Backed Testing

Strategy-backed testing is useful when you have historical data and want to apply certain strategies to be as precise as possible for all executions by influencing the exact distribution of orders. Heuristic algorithms enrich what external liquidity providers send and try to restore an optimal order structure inside of price levels.

In a typical First In First Out (FIFO) сase, the orders placed on a given price level could have various distributions, and the placement of your order in the distribution can affect the speed with which it passes.

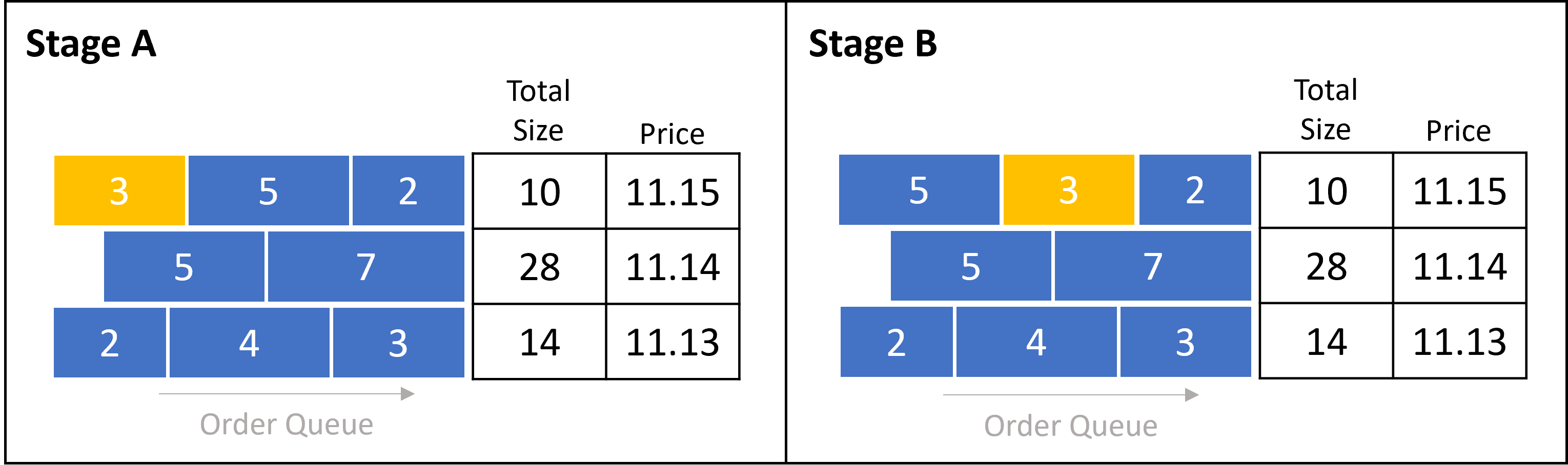

In the example below, where your order has a size=3 (highlighted yellow), your order will pass less quickly in Stage A than in Stage B because there is less liquidity before your order in Stage B.

The heuristic algorithm tries to build a Level3 order book from a Level2 feed by guessing what orders are on the market based on information about price levels.

Level2 to Level3 Conversion

There are three messages that can occur based on the actions the liquidity provider (LP) takes.

- L2EntryNew: Occurs when the LP sends a new price level. In this case, the algorithm can't build a distribution because there is no historical data. Therefore, the distribution is equal to level size.

- L2EntryUpdate (order size increase): Occurs when you receive an entry update increasing the order size on a specific price level. The algorithm adds extra quantity to the existing order at the end of the price level by placing a subsequent order.

- L2EntryUpdate (order size decrease): Occurs when you receive an entry update decreasing the order size on a specific price level. The algorithm considers two possible scenarios:

- When the trade already happened, the algorithm reduces the quantity of the first order to 6 and subtracts 2 from the second order. This is caused by the FIFO rules of execution the algorithm uses.

- When there is an order cancellation on the level, the algorithm assumes that the order at the end of the queue was cancelled, and reduces the size from the end of the level.

In the case of an order size decrease, to figure out which of the two possible scenarios occurred, the algorithm tries to match the L2 feed to market data with a feed with trades. Technically, these feeds are stored in the same timebase stream, but logically, they are two independent streams.

The size window parameters sizeOfWindowBeforeInTime and sizeOfWindowAfterInTime tell the system, that if there was an update at time X, it will find the trade between (X - sizeOfWindowBeforeInTime) (in milliseconds) before the message and (X + sizeOfWindowAfterInTime) (in milliseconds) after the message. If it finds the trade that matches the updated entry, it reduces order size from the beginningof the order. If it does not find a matching trade, it assumes there was a cancellation that happened from the end of the price level.

You can also specify size window parameters sizeOfWindowBeforeInMessages & sizeOfWindowAfterInMessages that are measured by the number of TimeBase messages before and after a given point.

Example Scenario

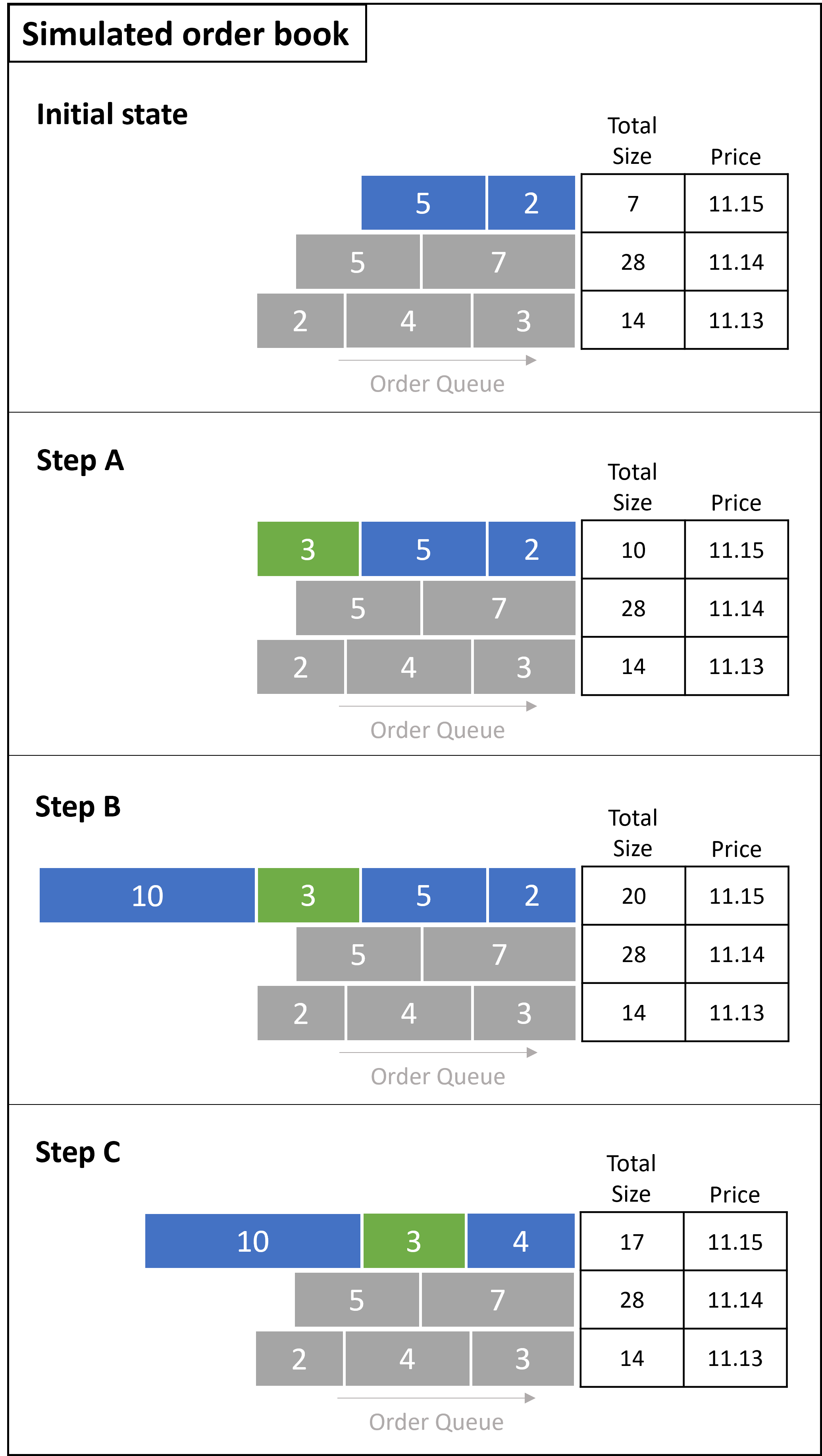

This section describes an example scenario inside the simulated order book.

- Initial Scenario: At $11.15, the order book has a total size of 7. The Simulator deconstructs the total size into orders of [5] and [2].

- Step A: The user places an order with size=3 at $11.15. This information is registered by the simulated order book, however it is not registered by the exchange's order book. The simulated order book at this price level becomes [3] [5] [2], with a total size of 10.

- Step B: A market data update occurs, and the exchange tells us that there are 17 contracts at the $11.15 price level. With this update, and including the order placed in Step A, the simulated order book becomes [10] [3] [5] [2].

- Step C: On the exchange, we see a trade of size=3 at $11.15 and the total size updated from 17 to 14. The simulated order book at this price level becomes [10] [3] [4].

Configuration

To deploy SIMULATOR for a specific exchange to Ember, add the following stanza to ember.conf. Let's imagine we want to deploy a simulator of the KRAKEN exchange:

KRAKEN: ${template.algorithm.SIMULATOR} {

subscription {

streams = "KRAKEN"

}

}

Now orders that have KRAKEN set as their destination are routed to this simulated market.

SIMULATOR requires market data to have exchange Id field in each market data entry. For the sample above, SIMULATOR expects all market data entries (bids/asks/trades) to have exchangeId set to KRAKEN.

Advanced Settings

There are a number of settings that can affect SIMULATOR behavior:

| Parameter | Default Value | Type | Description |

|---|---|---|---|

| bookSnapshotInterval | 60s | Duration | Interval of market data snapshots. |

| copiedCustomAttributes | null | String | Specifies the attributes copied from an order request to order events. Comma-separated list. Example: "1000,1001" |

| eligibleOrderParameters | null | String | Optional. Allows limiting supported order types or time-in-force conditions. Formatted as a comma separated list of pairs containing two values. The first value = order type (e.g., limit, market, stop, stop limit). The second value = order time in force (e.g., immediate or cancel, good till date, good till cancel). |

| exchangeMapping | String | Can be used to map exchange code in market data to exchange code in orders. | |

| executionMode | PESSIMISTIC | ExecutionMode | Determines whether orders placed close to the other side of the market have a higher/lower chance of execution. Possible values: OPTIMISTIC, PESSIMISTIC. If set to PESSIMISTIC, the algorithm executes orders only when they are crossing the market. If set to OPTIMISTIC, when sending orders inside of a spread, the order executes with a probability depending on how far the order is from the opposite side of the market. |

| feedMultiDestinationCastAddress | String | Related to timebase connectivity. | |

| feedStreamKey | null | String | Optional. When configured, simulator will generate own market data feed into TimeBase. |

| feedStreamMaxBufferSize | int | Related to timebase connectivity. | |

| feedTopicKey | String | Related to timebase connectivity. | |

| generateExecutionForLegs | true | boolean | Determines how multileg instruments are treated - whether the algorithm generates only one trade from the main instrument of the multileg symbol, or whether it adds different executions for any leg of the multileg instrument. If set to false (default), the algorithm does not generate executions per leg. If set to true, the algorithm generates executions per leg. Keep the default value. |

| latencies : { minValue: maxValue: } | Example: latencies : { minValue: 0.005 maxValue: 0.05 } | Introduce random latency between events in a minimum & maximum range. In seconds. | |

| local | true | boolean | Determines the security metadata that commissions are taken from. If set to false, Commissions, OrderPricePrecision, and OrderQuantityPrecision are looked up from the Central Security Master API. If set to true, they are taken from the security stream. |

| maxSnapshotDepth | int | Determines market depth of the L2 data feed. | |

| processHistoricalData | false | boolean | Determines whether orders placed in SIMULATOR are resumed or canceled after system restart. If set to false, orders are canceled. If set to true, orders are resumed. |

| sizeOfWindowAfterInMessages | 100 | int | Size of window in messages for matching trades with messages after trades. Measured in Milliseconds. Default should be good for most cases. |

| sizeOfWindowAfterInTime | 100 | long | Size of window in time for matching trades with messages after trades. Measured in Milliseconds. Default should be good for most cases. |

| sizeOfWindowBeforeInMessages | 100 | int | Size of window in messages for matching trades with messages after trades. Measured in number of messages coming from exchange. Default should be good for most cases. |

| sizeOfWindowBeforeInTime | 100 | long | Size of window in time for matching trades with messages before trades. Measured in number of messages coming from exchange. Default should be good for most cases. |

| stopOrdersExecutionMode | EXECUTE_BY_OPPOSITE_ SIDE_PRICE | StopOrdersExecutionMode | Determines what triggers an order stop. Possible values: EXECUTE_BY_TRADE_PRICE, EXECUTE_BY_OPPOSITE_SIDE_PRICE, EXECUTE_BY_SAME_SIDE_PRICE, EXECUTE_BY_SAME_SIDE_OR_TRADE_PRICE |

| supportL1DataFormat | false | boolean | Support for L1 format. |

| supportLegacyMarketDataFormat | false | boolean | Enables Legacy Market data format support. |

| symbolsLimit | 100 | int | Optional. Safeguard parameter that limits the total number of symbols the simulator uses to track the order book in one instance. (For some crypto exchanges you may need up to 20Mb/symbol. For traditional markets that have visible order book of 5-10 price levels this estimate is about 100Kb/symbol). |

| useClassicSimulator | false | boolean | Lightweight simulation mode from the "classic" simulator algorithm from QuantOffice. |

All these parameters can be placed into settings {} section of algorithm config:

algorithms {

SBINANCE: ${template.algorithm.SIMULATOR} {

subscription {

streams=[ BINANCE ]

}

settings {

symbolsLimit = 100

processHistoricalData = false

}

}

}

Exchange

By default QuoteFlow expects market data feed to identify exchange of each market data entry. Grouping market data entries by originating exchange ID enables accurate per-exchange order book tracking.

However, in some cases market data feed coming from single market may not identify exchange or mis-identify exchange. Startiung from QuoteFlow 3.8.32 there is a special flag to ignore exchangeId:

Example:

SGEMINI: ${template.algorithm.SIMULATOR} {

subscription {

streams=["gemini.data"]

}

settings {

symbolsLimit = 100

processHistoricalData = false

ignoreExchangeId = true # <---------- override market data entry exchange with "SIM"

}

How it will work:

• All market data coming to simulator will seem as market data from exchange with id "SIM". • All orders coming to the SGEMINI destination will seem as orders with exchangeId = SIM, no matter what is specified in exchangeId field • Following these, all events and all market data generated by this simulator will have exchangeId = SIM

CORRECTOIN algorithm

CORRECTION is pretty much like SIM but not even trying to simulate the market, just fills orders sent to it according to limit prices. It can be used to close positions or correct position sizes (yet another method that relies on sending dummy LIMIT orders that get instantly filled).